Adoption of ESG reporting – see details

On November 21, the Sejm adopted an amendment to the act on reporting obligations in the field of sustainable development. The obligation to submit an ESG report for 2024 will cover over 3,000 companies in Poland. Already in 2026, regulations will cover small and medium-sized enterprises listed on regulated markets. Is Polish business ready for this?

What do the new regulations mean for Polish businesses?

The introduction of mandatory ESG reporting in Poland will have a significant impact on companies that meet the criteria set out in the EU CSRD directive. As in other European Union countries, these companies will be required to prepare annual sustainability reports . These reports will have to meet legal requirements and standards included in the EU regulation. ESG documentation will be formally equal to financial reports, and its content will have to be approved by independent auditors. Failure to comply with the obligation to prepare a report may involve serious consequences, including criminal liability.

What about companies that will not be subject to reporting obligations?

Companies that will not be directly subject to the ESG reporting obligation will also feel the effects of the adoption of the EU regulation. Why? We suspect that many of them will have to collect and analyze data on environmental impact anyway. These will probably be necessary documents for contractors or companies belonging to the same capital group, which will be subject to the reporting requirement. It is possible that partners will be required to support in providing appropriate data. That is why we encourage representatives of small and medium-sized enterprises to take an interest in the topic of ESG now. If they do not implement an appropriate operational strategy, the business may suffer seriously in a few years. Customers are also more willing to turn to products and services of transparent suppliers.

A Practical Guide to ESG for Every Business

The Interzero team, knowing that both small and larger companies will need expert help to implement ESG, has prepared an e-book for you. This is a document that contains all the necessary information. It is written in simple, accessible language. In it, we explain what the CSRD directive is, introduce a reporting schedule, show how to communicate on the topic of sustainable development, and present the operational steps that should be taken to prepare your business for ESG. Fill out the form on our website and you will get completely free access to it. Your education is one of the most important factors in the development of the company you run.

Summary and schedule

The news about the adoption of reporting is just the tip of the iceberg. We know how much the Polish business model will change now and we want our clients to be prepared for it. As a company, we believe in technology and innovation. That is why we want to guide all interested parties through the ESG topic smoothly and calmly. We remind you that reporting will be mandatory:

- from 2025 – for large enterprises (over 250 employees and/or EUR 50 million in turnover and/or EUR 25 million in total assets),

- from 2026 – for SMEs listed on the stock exchange.

Environmental Sustainability Dashboard – a tool for non-financial ESG reporting – our proprietary consulting solution. The tool will streamline data collection and monitoring processes – thanks to which you can precisely track ESG indicators. This is a solution for companies that want to be ready for mandatory reporting. Customers get access to an online platform and full advice on assessing the impact on the environment.

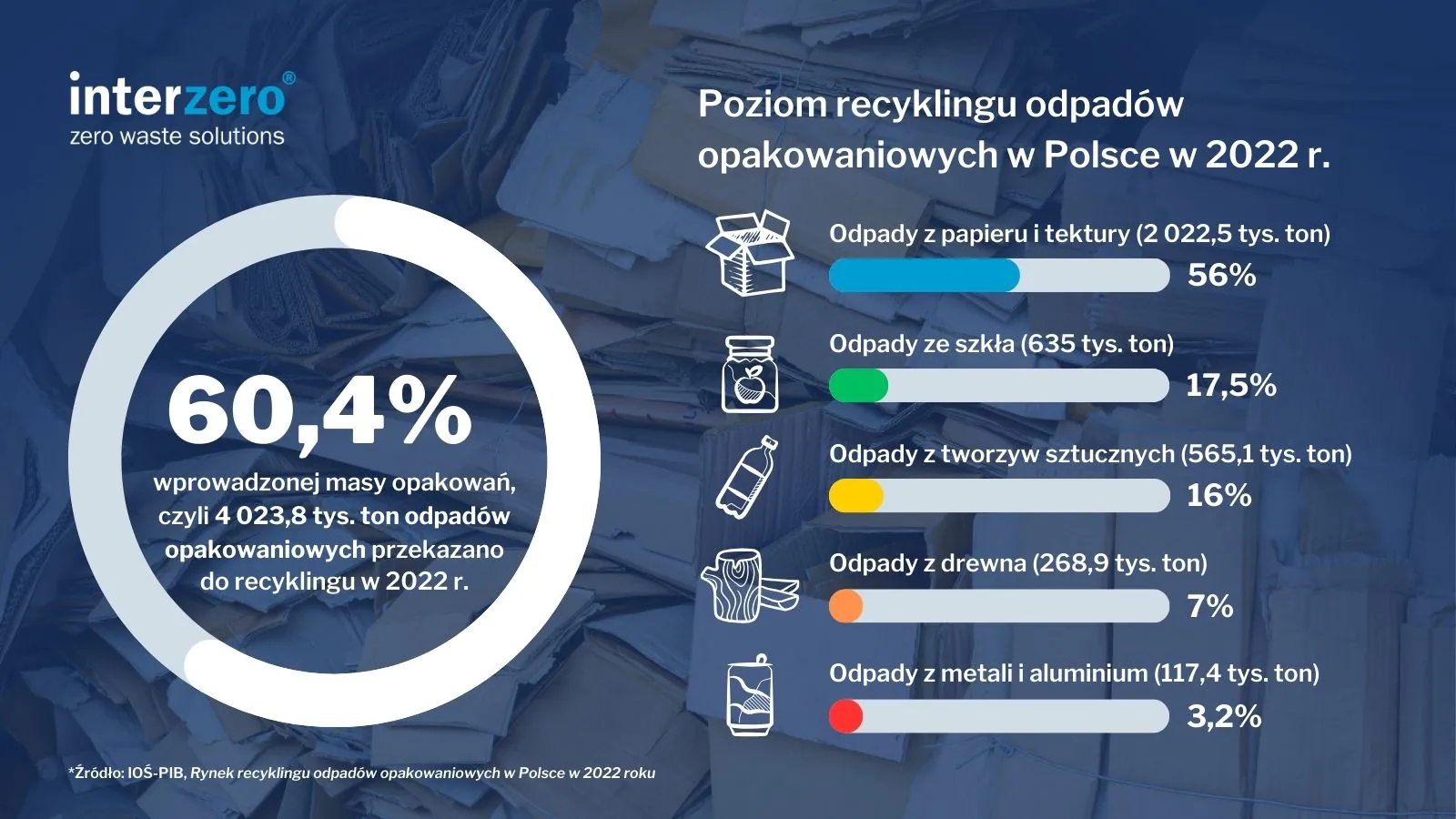

The recycling rate of packaging waste in 2022 was 60.4%

According to a report published by the Institute of Environmental Protection – National Research Institute, the level of packaging waste recycling was 60.4% in 2022. More than half of the recycled packaging waste (56%) was paper and cardboard waste. The highest recycling levels were also recorded for this fraction, amounting to 89.1% or 83.9%, depending on the methodology used.

Only and as much as 60.4% of packaging waste recycling

According to the calculations of IOŚ-PIB experts, in 2022, products packaged in 6,740 thousand tons of packaging were introduced to the market. Data from 532 installations were taken into account, which in 2022 received a total of 4,023.8 thousand tons of waste. Over 10% of this mass were so-called non-target materials (materials that are not processed in a given recycling process into products, materials or substances that are not waste). After correction, the total the mass of packaging waste recycled amounted to 3,608.9 thousand tons , including:

- 2,022.5 thousand tonnes of paper and cardboard packaging waste.

- 565.1 thousand tons of plastic packaging waste,

- 635 thousand tons of glass packaging waste,

- 268.9 thousand tons of wood packaging waste,

- 117.4 thousand tons of metal packaging waste.

According to the methodology adopted by the authors of the report, the recycling level of all packaging waste was 60.4%, which is 1.4% more than the minimum provided for in the Regulation of the Minister of Climate and Environment of December 19, 2021 on the annual recycling levels of packaging waste in individual years until 2030.

Recycling levels: achieved according to those introducing them, not achieved according to IOŚ-PIB

The recycling levels of all packaging waste were calculated in 2 variants. The first one was based on data from the introducers (entities that have entrusted statutory obligations to organizations) and independent (entities responsible on their own). These data show that the recycling levels of individual packaging waste for 2022 were as follows:

- metals – 93.9%,

- wood – 20.9%,

- plastics – 40.7%,

- glass – 65.3%,

- paper and cardboard – 89.1%.

Under this variant, the minimum annual recycling rates for packaging waste have been achieved for all types of packaging from which this waste originates.

The second variant of calculations presented in the report was based on the IOŚ-PIB methodology. The calculated recycling levels of almost all packaging waste (except plastics) are at a lower level:

- metals – 36.6%,

- wood – 16.7%,

- plastics – 45.8%,

- glass – 45%,

- paper and cardboard – 83.9%.

According to calculations based on the IOŚ-PIB methodology, in 2022 the entities introducing the waste did not achieve the minimum recycling levels for packaging waste made of ferrous metals and aluminium (amounting to 55% and 51%, respectively) and from wood (amounting to %).

Regardless of the variant , the lowest recycling rate was recorded for wood waste .

BDO register as a source of data for the IOŚ-PIB report

The source of the data presented in the report is the BDO register. The calculations do not include so-called free riders, i.e. producers or distributors who introduce plastic packaging or products in packaging into circulation and do not report them to the producer’s responsibility organization or a public authority, or do not take financial or financial and organizational responsibility in any other way for the management of plastic packaging waste, or report smaller quantities than they actually introduce into circulation.

The analysis prepared by IOŚ-PIB takes into account waste with the following codes:

- 15 01 01 – paper and cardboard packaging,

- 15 01 02 – plastic packaging,

- 15 01 03 – wooden packaging,

- 15 01 04 – metal packaging,

- 15 01 05 – multi-material packaging,

- 15 01 06 – mixed packaging waste,

- 15 01 07 – glass packaging.

The actual amount of packaging waste generated in Poland and recycled was calculated as follows – by adding the mass of waste recycled in Poland and recycled abroad, and reducing the result by the mass of waste imported to Poland for recycling.

Source: [1]

From 2025 BDO fees will increase. How much will the annual fee and registration fee be?

From 2025 BDO fees will increase. How much will the annual fee and registration fee be?

The draft regulation of the Minister of Climate and Environment shows that there will be a significant increase in the annual and BDO registration fee as early as 2025. For micro-entrepreneurs, it will be an increase from PLN 100 to PLN 200, and for other entities – from PLN 300 to as much as PLN 800.

Increase in BDO registration and annual fees

On 24 October 2024, a draft regulation of the Ministry of Climate was published on the website of the Government Legislation Centre, which provides for an increase in the registration fee and annual fee rates applicable from 2018.

From 2025 they will amount to:

- PLN 200 for micro-entrepreneurs,

- PLN 800 for other entrepreneurs.

This means an increase of 100% and 166%, respectively. The increase will apply to all entities that have a statutory obligation to register with BDO.

Check if your company is required to register with BDO!

In accordance with the provisions of the Waste Act, BDO fee rates have been set at PLN 50 to PLN 2,000. Their amount should not be an obstacle to obtaining an entry in the register or conducting business activity , especially for micro-entrepreneurs and small and medium-sized enterprises.

The draft prepared by the Ministry of Climate and Environment was then submitted for review by, among others, employers’ organizations and the Joint Government and Local Government Commission. Due to the need to ensure that the draft regulations enter into force on 1 January 2025, the deadline for reviewing the draft regulation was only 5 days.

In 10 years, medium and large enterprises will pay PLN 194.6 million, micro and small enterprises – PLN 70.9 million.

According to calculations by the Ministry of Climate, thanks to the increase in BDO fees , the total revenues from the registration and annual fees in 2025–2034 will amount to:

- for the state budget PLN 243.5 million,

- for the voivodeship budget (voivodeship marshals) PLN 134.8 million.

In the forecasted 10-year period, medium and large enterprises will have to incur additional costs in the amount of PLN 194.662 million, and micro and small enterprises in the amount of PLN 70.942 million.

Why will BDO fees increase?

The reasons for the increase in the registration and annual fees in BDO were explained in the justification for the draft regulation. As indicated by the Ministry of Climate, the fee rates have not been updated for over 6 years . During this period , the cumulative inflation amounted to 43.9% , which meant that the real revenues from the registration and annual fees actually decreased. Moreover, since 2018, there has been a significant increase in the costs associated with maintaining, running and developing BDO , which contributed to a decrease in the funds that can be allocated to the appropriate functioning of the Database on products and packaging and on waste management.

The proposed rates of the registration fee and annual BDO fee in the draft regulation take into account the aforementioned increase in costs both on the part of the province marshals and on the part of the state budget. Let us recall that the fees from entrepreneurs for entry and maintenance of the register are collected by the province marshal . They constitute 35.65% of the income of the province budget (province marshal), who is responsible for maintaining the register, and 64.35% of the income of the state budget and the Ministry of Climate and Environment, who are the BDO Administrator.

The legislative process can be followed on the website of the Government Legislation Centre .

Who is obliged to pay BDO fees?

The list of entities obliged to register with the BDO, and therefore to pay the annual and registration fees, is exhaustively specified in the Waste Act.

The following persons are required to pay the registration fee and the annual fee:

- equipment introducers and authorized representatives,

- introducing batteries or accumulators,

- introducing vehicles,

- manufacturers, importers and intra-Community purchasers of packaging,

- introducing products in packaging into the territory of the country,

- introducing tires into the territory of the country,

- introducing lubricating oils into the territory of the country.

Increased rates are not the only new thing at BDO

For some entrepreneurs, increased BDO rates are not the only concern. From 2025 the obligation to keep records of hazardous waste was introduced and at the same time the existing exemption used by entities generating small amounts of waste was abolished. These changes will primarily affect representatives of the beauty industry, including hairdressers, barbers, make-up artists, nail, eyelash and eyebrow stylists. More information at the link.

From 2025 an obligation to segregate construction and demolition waste into 6 fractions was also introduced. The most important change is the abandonment of the obligation to segregate R&D waste at the place of its generation – the entrepreneur can commission this to another authorized entity that has permits and an entry in the BDO, provided that an appropriate agreement is concluded. More information in the entry at the link.

68% of micro and small companies already have an ESG strategy. Are you among them?

68% of micro and small companies already have an ESG strategy. Are you among them?

Small business is becoming increasingly involved with ecology – nearly 70% of the smallest Polish companies have no doubt that implementing actions that are beneficial to the Earth not only affects the environment, but also profitability. The vast majority of initiatives undertaken by small entrepreneurs result from the expectations of other entities, including consumers.

ESG strategy as an opportunity for company development and increased customer loyalty

According to the report by EFL and Credit Agricole Bank Polska Diagnosis of the level of knowledge and practices in the ESG area in micro and small companies , over 2/3 of entrepreneurs have already decided to develop an ESG strategy for their company . It is worth emphasizing that these actions usually result from:

- growing customer expectations – 56%,

- requirements of financial institutions – 51%,

- conditions set by suppliers and contractors – 46%.

Even more, as many as 81% of micro and small entrepreneurs believe that sustainable development activities are important for their businesses. Among representatives of such companies, issues related to environmental protection and stopping climate change are perceived not as a burden and cost, but as an investment in the development of the company.

Small businesses see numerous benefits from implementing ESG practices. In their opinion, such activities increase employee motivation and productivity, build customer trust and loyalty, and increase brand value.

What sustainable practices do small businesses choose?

Interestingly, in the smallest companies on the market , the ESG strategy is usually contained in a different document . This practice is chosen by as many as 33% of respondents. Only 10% of entrepreneurs prepare a separate document for this purpose, and as many as ¼ do not create one at all, but apply unwritten rules. This is a kind of contrast to the largest market players, who have already been required to report individual ESG indicators in writing this year .

The report prepared by EFL and Credit Agricole Bank Polska also indicates ESG actions that representatives of micro and small companies declare they will take. Among them, we can find:

- recycling and waste management – 74%,

- water consumption monitoring – 64%,

- energy consumption monitoring – 68%,

- thermal modernization of buildings – 52%,

- installation of renewable energy systems – 42%,

- low-emission car fleet – 39%.

Companies are much less likely to measure their own and their suppliers’ carbon footprints . Such actions are declared by 22% and 18% of respondents, respectively. This may be due to the adoption of a small-step strategy – micro and small enterprises must measure their strengths and implement subsequent ecological practices gradually.

Carbon Footprint Monitoring and ESG Indicators as a Future Trend

In the coming months and years, we can expect more activity in terms of striving for low or zero emissions and implementing tools that allow you to calculate and monitor a company’s carbon footprint . One such tool is the Environmental Sustainability Dashboard , which combines the ability to calculate and control ESG indicators with an advisory service that will help you identify key data for your company and learn how to improve your environmental performance.

Conclusions from the analysis of data from the Environmental Sustainability Dashboard tool are also the basis for developing a sustainable development strategy in each company , setting directions for pro-ecological changes and for tracking the effectiveness of actions already taken. Why is it so important? Take part in the online training „Non-financial reporting and sustainable development of the company” , during which you will learn when and what to report and get to know the ESD tool from Interzero better.

Sources:

- Report: 68% of micro and small companies have an ESG strategy report, https://media.efl.pl/informacje/raport-68-mikro-i-malych-firm-posiada-strategie-esg

Universal USB-C charger - the new EU standard

Why will the universal USB-C charger be standard for all devices?

The universal USB-C charger will be standard for everyone by the end of 2024. Why? This is a top-down regulation of the European Union, which is primarily intended to guide consumers towards more ecological choices when shopping.

Under EU regulations, all phones, tablets and cameras sold in the EU will have to have a USB Type-C port by the end of 2024, and from spring 2026 the requirement will also be extended to laptops.

In this article you will learn:

- what type of chargers dominate the market and why were there EU demands for devices equipped with a charging port;

- which mobile devices will be affected by these changes and when the new regulations will come into force;

- in what direction is the European Parliament heading regarding the amount of waste and ecology in general.

Universal charger for all devices

The devices covered by the regulations include, among others, mobile phones. , tablets , game consoles , e-readers and others portable devices. All those devices that are charged by wire and operate at up to 100W will have to be equipped with a USB Type-C port – regardless of the manufacturer. This is a groundbreaking decision that aims to simplify the lives of consumers and reduce the negative impact of electrical and electronic waste on the environment. The European Commission and the European Parliament unanimously recognized that this solution will have a positive impact on the ecosphere and will allow for a minimal reduction in consumerism.

Customers can choose whether they want to purchase a new device with or without a charger. This should reduce the accumulation of e-waste in homes, and therefore the throwing of e-waste into inappropriate containers. The EU estimates that broken and unused chargers constitute around 11,000 tonnes of waste. This is a frightening amount – but another question arises – what about chargers with other tips when the EU recommendations regarding USB-C come into force?

Are all manufacturers ready for change?

European Commission research shows that half of all chargers sold in 2018 in EU countries used a USB micro-B connector. Only 29% had a USB-C connector, and 21% had a Lightning connector, used by Apple since 2012. Standardizing chargers to a single standard will make many proprietary charging ports (like Apple’s Lightning) obsolete in Europe. Manufacturers therefore argue that once chargers are standardized to USB-C, all the others that are already in consumers’ homes will go to the trash. Researchers in an issue of the Northwestern Journal of International Law & Business investigated the matter. In fact, as of 2019, only 29% of phones sold in the European Union used USB-C chargers. Therefore, forcing the switch to USB-C would make almost 71% of chargers useless for consumers. Customers who buy newer devices with a USB-C port will no longer be able to reuse their older chargers with a different input.

Customer education – in line with new regulations. What changes will come with the unification of device chargers?

However, if we look at the matter in a broader, long-term perspective, according to analyses by the European Commission, thanks to the unification of the charging standard, European citizens will be able to save up to 250 million euros per year. In addition to economic benefits, the new regulations aim to reduce the amount of electronic waste , which is a significant step towards sustainable development. Guidelines regarding product charging requirements are to appear on device labels. Perhaps in a few years, we will only need one charger for all equipment at home or in the office?

Click here again! You can check how the paper recycling rate is growing in Europe! ♻️

How much is the deposit for bottles and cans? Check out the new rules!

We know the deposit amount for bottles and cans - check the current rates

On July 16, 2024, the long-awaited regulation of the Minister of Climate and Environment on the amount of the deposit for packaging covered by the deposit system was published. How much will the deposit be for beverage bottles and cans?

Deposit for bottles and cans in the Polish deposit system from 2025

In the Polish deposit system, the deposit amount will depend on the type of packaging. According to the latest regulation, from 2025, the deposit rates for bottles and cans will be as follows :

- disposable plastic bottles up to 3 l – PLN 0.50,

- metal cans up to 1 l – PLN 0.50,

- reusable glass bottles up to 1.5 l – PLN 1.00.

The Regulation was issued on the basis of the delegation contained in Article 40m section 2 of the Act on the management of packaging and packaging waste ( OJ 2013 item 888 ). According to its provisions, the amount of the deposit should be an incentive for consumers to return packaging and packaging waste , and at the same time be set at a socially acceptable level. The maximum amount of the deposit specified in the act may be PLN 2, which is why the Ministry should monitor the situation in the first months and years of the deposit system’s operation and react on an ongoing basis by updating the amount of the deposit.

The aforementioned regulation shall enter into force 14 days after its announcement and shall come into force on the last days of July 2024.

Let us recall that the first draft of the regulation assumed the adoption of a uniform rate of PLN 0.50 for all packaging covered by the deposit system. However, it was met with numerous objections from bottlers and representatives of the waste industry, who pointed out that the proposed deposit rate for reusable glass bottles is lower than the deposit currently used in private return systems (PLN 1).

Changes in the deposit system – what have the last few weeks brought?

The final determination of the deposit amount for individual types of packaging covered by the deposit system is not the only novelty in the Polish deposit system that has been presented to the public in recent weeks.

- Another, third deposit system operator has entered the game. On July 17, 2024, the Minister of Climate and Environment allowed the Entity representing OK Operator Kaucyjny SA to create a deposit system covering single-use plastic bottles and metal beverage cans.

- The deadline for mandatory inclusion of reusable glass bottles in the deposit system has been postponed by one year. As a result, the currently operating private collection systems for such packaging can legally operate until 2026.

- Milk and other dairy product packaging has been excluded from the deposit system , which is in line with the dairy industry’s demands. Initially, the deadline for including them in the deposit system was to be postponed by a year (to 2026), but ultimately the Ministry of Climate and Environment withdrew from this idea altogether.

- The logo of the deposit system was presented , which will be placed on all packaging covered by the Polish deposit system.

Get ready for the deposit system with Sielaff bottle machines

Interzero is the only official distributor in Poland that cooperates with the renowned German manufacturer of bottle vending machines – Sielaff. Thanks to this cooperation, we offer our customers the highest quality devices, designed with durability, efficiency and advanced technology in mind.

We offer full support – from consulting and device installation, to servicing and integration with IT systems. Our team of experts ensures that the implementation of bottle vending machines runs smoothly, and your company gains a modern tool tailored to the needs of customers. Check out the device offer at the link.

80% of paper recycling in Europe | Latest CEPI data 2023

Paper recycling in Europe is on the rise. Discover key data from the CEPI 2023 report

On July 9, 2024, the latest CEPI report was published, presenting production statistics for the European paper sector for 2023. The data from the report indicate a deepening decline in paper and cardboard production. At the same time, the recycling rate of the raw material is increasing, which reached almost 80% last year.

Decline in paper and cardboard production in Europe reflects global trends

The year 2023 was marked by declines in the paper industry. Paper and cardboard production fell by as much as 13% compared to 2022. It seems that recent years have been a slippery slope for the paper industry – paper consumption (by 13.5% vs. 2022) and pulp production (0-17.5% vs. 2022) are also falling significantly. However, this is not a local problem – in the same period we are observing a global slowdown, which is not as severe as in Europe . The EU economy as a whole has lost its dynamics in the face of high living costs (including energy prices), tightening monetary policy and weak external demand.

The dynamics of production of individual types of paper and cardboard products in 2023 were very diverse. Compared to the previous year, the amount of cardboard packaging produced fell by 11%, and the amount of newsprint by 20.6%. The largest declines in production, reaching 23.7%, were recorded in the graphic paper category. Sanitary and household paper proved to be the most resistant to market turbulence – this segment decreased by only 3.4%.

80 percent recycling rate – the paper industry is getting closer to the dream of a circular economy

From the perspective of the paper industry, the data presented in the CEPI report are quite pessimistic. However, representatives of the waste and recycling industry have a breath of optimism – in 2023 . the average recycling rate in the EU-27, Norway, Switzerland and the UK was as high as 79.3% (an increase of 8.2 percentage points compared to 2022). Thus, 6 years ahead of schedule, the goal of the signatories of the European Declaration on Paper Recycling, who committed to achieving a 76% paper recycling rate by 2030, has been fulfilled. The record high annual recycling rate indicates the autonomy of the industry and brings it closer to realizing the idea of a circular economy .

Interestingly enough, The increase recorded in 2023 is due to a significant, 12% decrease in the consumption of paper and cardboard . This means that not only industry representatives, but also consumers are becoming more aware and are starting to reduce the use of paper products and cardboard and paper packaging.

CEPI 2023 Report Shows Progress in Decarbonising Paper Industry

Despite numerous results below the line, the paper sector also has reasons to be satisfied. For many years The decarbonization of this industry is gradually progressing. In 2023, CO2 emissions fell by another 5.8%, which means that a total reduction of more than 46% in carbon dioxide emissions has been achieved since 2005.

As we read in the statement by the Director General of CEPI:

„Given the context, the pulp and paper industry in Europe can be proud of what it has achieved in terms of climate action and circularity. In a more favourable and predictable regulatory environment, our prospects can be very positive and our contribution to the EU Green Deal even greater.”

Due to the decarbonization goals set by the European Commission, it is estimated that emissions reduction will proceed even faster in the coming years . However, this is conditional on further increases in investment outlays, which, in the current difficult market situation, is one of the greatest challenges.

Source: European pulp & paper industry. Key statistics 2023, CEPI, https://www.cepi.org/wp-content/uploads/2024/07/Key-Statistics-2023-FINAL.pdf

Raw materials for paper production – what is paper made from in Europe?

What is paper made of – types and species of trees

Softwood (75% of production) and hardwood (25% of production) are used for primary paper production in Poland and throughout Europe. It comes mainly from commercial forests, where planned tree cultivation is carried out for logging. Another source of wood is the so-called maintenance logging of other forests, carried out in order to provide neighboring trees with optimal conditions for growth and crown development.

The most popular species of wood for paper production are:

- spruce – 40.5%,

- pine (so-called paperwood) – 35%,

- birch – 11.4%,

- eucalyptus – 9.1%,

- beech – 1.5%,

- aspen – 1.2%

- other (hornbeam, ash, maple, acacia, oak, alder, poplar, willow, chestnut) – 1.3%.

The decline in paper production in recent years also translates into lower interest in the primary raw material. In 2023, the quantitative consumption of softwood species fell by 1.1%, and hardwood species by 5.7%.

Raw material for paper production "made in Europe"

According to the CEPI report, as much as 91% of the wood used for paper production in CEPI countries comes from their native forests . This is the highest rate since 2000 and a slight increase compared to 2022 (by 1 percentage point). Another 6.5% is wood imported from EU countries that are not CEPI members. Only 2.5% of the wood comes from outside Europe. This means that Europe is almost self-sufficient in terms of obtaining raw material for paper production .

At this point, it is also important to emphasize the role of the raw material, which is recycled paper. In 2023, more than 53 million tons of waste paper and other paper waste were recycled in CEPI countries and reused to produce paper products. Cardboard is the leader here – as much as 95% of cardboard and cardboard packaging is made from recycled paper.

Find out how paper is made in the first and subsequent cycles.

Wood chips – waste as a raw material for paper production

In addition to wood in bales, wood chips are also used to produce paper . These are small pieces of wood that are created as post-production waste from, among others, the furniture, sawmill, packaging and construction joinery industries. The scale of their use may be surprising – in 2023, as much as 21.4% of all wood intended for the paper industry were chips .

According to the authors of the CEPI report, the use of industrial waste in the form of wood chips for paper production is a significant contribution to the circular economy . Although CEPI traditionally does not consider it recycling, such use of wood chips falls within the definition commonly accepted in the waste industry. Considering the highest paper recycling rate in history (almost 80%), it can be said that CEPI countries have learned their lesson about circularity and are well on their way to creating a circular economy.

Source: European pulp & paper industry. Key statistics 2023, CEPI, https://www.cepi.org/wp-content/uploads/2024/07/Key-Statistics-2023-FINAL.pdf

Registration with BDO: Is it an obligation for every entrepreneur?

Registration with BDO: Is it an obligation for every entrepreneur?

What is BDO?

BDO ( Database on products, packaging and waste management ) is an IT system used to collect and manage data on waste management. It allows for electronic submission of reports and keeping waste records.

Who must register with BDO?

The obligation to register with BDO applies to both new companies and those that have been operating for many years. Entrepreneurs who must be entered in the register are:

- They produce waste and keep records of it.

- They introduce packaged products, vehicles, tires, lubricating oils, batteries and accumulators to the Polish market.

- They produce or introduce packaging to the Polish market.

- They make intra-Community acquisitions of packaging.

- They introduce electrical and electronic equipment into the country.

- They run a shop or wholesale store and provide customers with plastic bags subject to a recycling fee.

Consequences of not registering with BDO

Failure to register or incorrect registration with BDO may prevent entrepreneurs from fulfilling important environmental obligations and expose them to severe financial penalties. Failure to register may result in imprisonment or a fine of up to PLN 1,000,000.

How to register with BDO?

Get help from the experts at Interzero . Their BDO registration service includes:

- Determining the actual scope of your company’s activities.

- Identification of sections for entry and codes of waste generated.

- Preparation and submission of an application for registration in BDO

Please note that the registration process may take up to 30 days from the date of application, so there is no point in delaying the formalities.

Changes to the deposit system! We know what's going on with VAT, deposit amounts, collection levels and dairy product packaging!

Changes to the deposit system! We know what's going on with VAT, deposit amounts, collection levels and dairy product packaging!

As of July 31, 2024, a regulation of the Minister of Climate and Environment came into force regulating the amount of the deposit for all types of packaging that will be included in the deposit system.

We would like to remind you that in accordance with the regulation, the deposit amount for one package will be:

- For single-use plastic beverage bottles with a capacity of up to three litres, including their plastic caps and lids, excluding glass or metal beverage bottles with caps and lids made of plastic – 50 groszy

- For metal cans with a capacity of up to one liter also – 50 groszy

- For reusable glass bottles with a capacity of up to one and a half liters – one zloty.

Read the regulation of the Minister of Climate and Environment regarding the amount of the deposit.

What’s new in the draft bill amending the provisions on the UD45 deposit system after the changes resulting from public consultations?

A draft bill amending the deposit system (UD45) has been published on the website of the Government Legislative Centre.

The most important provisions concern:

- closing the deposit circuit, which will help to tighten the system and facilitate monitoring the deposit flow,

- reducing the level of selective collection of packaging and packaging waste to a fixed threshold of 77% in 2025-2028,

- exclusion from the obligation to collect milk packaging and dairy products,

- increasing the role of the minister as a body supervising the activities of operators,

- increase in product fee,

- regulations on VAT,

- introduction of a provision on so-called reverse logistics.

The full document is available on the Government Legislation Center website. We encourage you to read it at the link .

The final countdown to the introduction of the deposit system in Poland is underway! The deadline of January 1, 2025 remains binding.

Stay up to date with information on the deposit system in Poland and follow our LinkedIn profile