Environmental levy 2025 and 2026 - key information for businesses

Environmental levy 2025 and 2026 - key information for businesses

The Environmental Protection Law imposes an obligation on those using the environment to pay an environmental fee. If your company's activities have an impact on the environment, it is probably your responsibility to calculate and pay the fee. Who should pay the fee and by when? Where is the best place to check the current environmental fee rates? We suggest.

What does the environmental levy apply to and result from?

Entities using the environment are required to pay a fee for this, sometimes referred to as an environmental charge. It is a kind of compensation for environmental damage natural resources resulting from the activities of a company, an institution or an individual.

Obligation to pay an environmental fee covered activities:

- resulting in emissions of gases or dust,

- requiring the possession of emission allowances,

- involving waste disposal.

The amount of the environmental fee depends mainly on the amount and types of dust and gases introduced into the air and the amount and type of waste stored, as well as the duration of storage.

Funds raised from fees are mainly allocated to national and provincial environmental funds.

Who has to pay the environmental fee?

Environmental charges must be paid by environmental beneficiaries, which include:

- entrepreneurs,

- organisational entities which are not entrepreneurs,

- persons engaged in agricultural production activities,

- other natural persons who use the environment to the extent that a permit is required.

Obligated entities They must also determine the amount of the fee themselves for the calendar year in question, and pay it into the appropriate bank account. Amount of the annual environmental fee shall be calculated in the environmental report.

NOTE: an environmental fee is not payable if it does not exceed PLN 800 for one type of environmental use (e.g. for the introduction of dust and gases).

What are the rates of the environmental levy?

Environmental charge rates changes in each reporting year. The list of rates is published in an annual notice by the Minister for Climate and Environment.

The calculation of the fee for the introduction of gases and dust is made on the basis of the annual volume of actual emissions specified in the report to the National Database on Emissions of Greenhouse Gases and Other Substances kept by the National Centre for Balancing and Managing Emissions IOŚ-PIB (KOBiZE).

Entities that use the environment without having a legally required permit or decision must pay an increased fee. Need support in obtaining permits, authorisations or decisions? Entrust the preparation of all environmental documentation to Interzero!

Environmental levy rates for 2025.

The upper unit rates for environmental charges in 2025 were set at the following level:

- 570.62 PLN/kg of gases or dust introduced into the air,

- PLN 418.03/Mg (tonne) of waste placed in the landfill.

You will find the unit charge rates for the individual gases, dusts and wastes in the table attached to the Notice from the Minister for Climate and Environment of 28 July 2024 on the rates of environmental charges for 2025.

Environmental levy rates for 2026.

The upper unit environmental charge rates in force in 2026 were as follows:

- 591.16 PLN/kg of gases or dust introduced into the air,

- PLN 433.08/Mg (tonne) of waste placed in the landfill.

You will find the unit charge rates for the individual gases, dusts and wastes in the table attached to the Notice from the Minister of Climate and Environment of 6 August 2025 on the rates of environmental charges for 2026 .

By when is the environmental fee payable? Deadlines

The environmental fee is payable by 31 March of the current year for the previous year. This means that the environmental fee for 2025 must be paid by the deadline of until 31 March 2026. (Tuesday).

You should pay the environmental fee to the account of the marshal's office proper by virtue of the place of use of the environment. An exception is made for gases and dust discharged into the air from non-stationary technical equipment, e.g. transport. In this case, the fee shall be paid to the account of the marshal's office competent for the seat of the entity.

Who does not pay the environmental levy? Catalogue of exemptions

The financial consequences of using the environment do not apply to the smallest entities whose activities have little impact on the environment - an environmental fee is therefore not paid, if it does not exceed PLN 800 for one type of environmental use (e.g. for the introduction of dust and gases).

Entities for which the calculated fee for one type of environmental use is between PLN 100 and PLN 800 are only obliged to submit a list of the scope of environmental use. If the fee is less than PLN 100, it is not necessary to submit the list.

BDO annual packaging report 2025. - key information on the report on products, packaging and waste management

BDO annual packaging report 2025. - key information on the report on products, packaging and waste management

One of the annual obligations of those introducing packaged products, packaging and certain types of products is to prepare a report in BDO. What is the scope of the packaging report at BDO? Who has to submit it and by when? Find out the most important information about the product, packaging and waste management report.

What does the BDO packaging report cover?

The packaging report is a document containing information on the quantities and types of the packaging and products that the trader has placed on the market during the calendar year in questionas well as types and masses the packaging and post-consumer waste that the undertaking has recovered and recycled in this period.

The catalogue of packaging and products to which the report on products, packaging and the management of waste from them applies includes:

- wrapping, transport and packaging, including plastic bags covered by the recycling levy,

- Tyres,

- oils and greases,

- vehicles,

- electrical and electronic equipment (including waste),

- batteries and accumulators,

- selected single-use plastic products,

- fishing gear.

The exact scope of the report on products, packaging and the management of waste arising from them depends on the type of activity carried out by the company in a given calendar year.

Who reports on products and packaging for 2025?

Among others, the following are required to submit a packaging and product report to BDO for 2025:

- producers and exporters of packaging,

- manufacturers, exporters, importers and traders making intra-Community deliveries of packaged products,

- those introducing single-use plastic products covered by the SUP Act,

- wholesalers of oils, lubricants and tyres (including automotive shops and wholesalers),

- retailers of household appliances, consumer electronics and other electrical goods,

- vehicle dealers and importers,

- shops and wholesalers that offer plastic shopping bags to customers,

- bail system operators (representative entities),

- authorised representatives of producers of electrical and electronic equipment.

The full catalogue of entities obliged to submit an annual report on products, packaging and the management of waste arising from them can be found in Article 73 of the Waste Act.

Entrepreneurs who are required to submit a report must be registered with BDO and assigned an individual registration number! If your company has not yet obtained an entry, Take advantage of our support in registering with BDO.

By when to submit the 2025 packaging report?

The packaging and product report shall be submitted by 15 March of the current year for the previous year.

In 2026. deadline for submission of the report on products, packaging and the management of waste arising therefrom for the year 2025 falls on Monday 16 March 2026 r. - 15 March is a Sunday and therefore a public holiday, which postpones the deadline to the next working day, which is precisely 16 March 2026.

Businesses that have ceased operations are required to submit a packaging report within seven days of the date of termination.

How to report on products, packaging and the management of their waste?

A report on products, packaging and the management of waste arising from them must be submitted electronically, through an individual account in the BDO system. The report sent will go to the marshal of the province with jurisdiction over the place of business.

You can fill in your BDO report on products, packaging and the management of their waste yourself or with the help of Interzero experts.

-

How to submit the BDO 2025 report yourself?

Log in to your account in the BDO system. From the menu on the left, select "Reporting"and then press the "Reporting on products, packaging and waste management". Once in the list of reports, click on the button "+ New report. You will be redirected to a form containing fields in which you should enter your company details.

-

How do I hand over reporting in BDO to Interzero's environmental experts?

Want save time and avoid costly mistakes? Do you prefer to focus on your business and leave the paperwork to the experts? We would be happy to take over your reporting duties at BDO. Fill in our contact form i describe the support you need. Our expert will contact you immediately to get to know your expectations and discuss the details of the cooperation.

Choosing Interzero you gain peace of mind, security and the assurance of reliable, timely performance of your duty reporting. You will also have access to the My Interzero portal, with the help of which you can quickly and conveniently provide us with the quantities and weights of the packages and products you have entered. We will take care of the rest!

Do you also have other reporting obligations? Find out what other reports we can prepare on your behalf!

What information should the packaging, products and waste management report contain?

Each report on products, packaging and the management of waste arising from them shall include a set of information identifying the submitting entity (i.e. your company) and information on the type of products and packaging being introduced.

The specific scope of the BDO packaging report will depend on the category of covered businesses your company falls into.

The section identifying the entity (Section I of the report) includes:

- the name of the entity,

- address of residence or registered office,

- BDO registration number,

- VAT number (if applicable),

- European tax identification number (only for certain introducers of batteries and accumulators).

In the following sections you will find information on products and packaging introduced. Check the indicative scope of the reports for:

- Packaging and packaging waste

- Plastic bags

- Oil, grease and tyres

- Plastic disposables

- Vehicles

- Electrical equipment

- Batteries and accumulators

Remember, that the exact scope of its report on packaging, products and waste management you can check after logging in to your account in the BDO system.

FAQ

Find out the answers to the most common questions about the report on products, packaging and the management of their waste.

The report on products, packaging and waste management shall consist of to the marshal of the province with jurisdiction over the place of business. Please note that you can only submit these electronically by logging into your individual account in the BDO system.

Receiving a call to submit a correction to the packaging, products and waste management report means that the original document has not been completed correctly. Correction usually to be submitted within 14 days - The exact date and scope of the data to be corrected will be indicated in the request. Obvious mistakes and simple errors can sometimes be corrected by yourself. However, if the errors are numerous and the deadline is impending, It is worthwhile using the support of Interzero's environmental consultants.

Our experts will be happy to help you with the correction of your packaging and product report. We have many years of experience in preparing environmental reports, so we will quickly identify all errors and efficiently we will prepare the correction on your behalf. Write to us using the contact form and present your problem!

If your company is an introducer of packaging or an exporter of packaging, include information on the packaging report in BDO:

- the weight of packaging produced and imported from each material,

- the weight of the packaging of each material (including packaging of hazardous substances) in which the products were placed on the market,

- the weight of packaging waste recovered and recycled by type and by municipal and non-municipal waste,

- the achieved levels of recovery and recycling for packaging waste made of specific materials,

- the weight of packaging of each material exported abroad (if applicable), broken down into disposable and reusable packaging,

- number of lightweight bags (15 to 49 micrometres) made of plastic launched,

- the amount of funds allocated to public education campaigns and the campaigns organised with these funds.

If the required recycling rates are not achieved, the report must also indicate the amount of product fee due, calculated separately for each packaging material.

Enter all this information in Section II of the report.

High product fee? Calculate how much you will save by handing over your obligation to the Interzero Recovery Organisation!

If you offer plastic shopping bags to customers, you should include information in your packaging report:

- number of lightweight bags (from 15 to 49 micrometres): acquired and issued,

- number of other bags (50 micrometres and above): acquired and issued.

Enter this information in Section II of the report.

For more practical advice, see the guide to the recycling levy in a nutshell >>.

If your company introduces oils, lubricant preparations or tyres, include information in the product report in BDO:

- weight of products introduced,

- the mass of post-consumer waste recycled and recovered,

- the achieved levels of recovery and recycling of post-consumer waste

If the required levels of recovery and recycling are not achieved, the report shall also indicate the amount of product fee due calculated separately for each product.

Enter all this information in Section III of the report.

High product fee? Calculate how much you will save by handing over your obligation to the Interzero Recovery Organisation!

If your company introduces single-use plastic products, include information on the following in the product report in BDO:

- the weight and number of single-use plastic products introduced,

- the weight of plastic-containing fishing gear introduced and collected,

- achieved levels of separate collection of plastic waste fishing gear.

Enter all this information in Section III of the report.

If your company is an introducer of vehicles (manufacturer, importer, intra-Community buyer of vehicles), include information on the product report in BDO:

- number of imported vehicles,

- the number of days on which there were not enough further dismantling stations or vehicle collection points to provide the vehicle collection network,

- the amount of the charge for not having a vehicle collection network.

Enter all this information in Section IV of the report.

If your company introduces electrical and electronic equipment, include information in the product report in BDO:

- the mass of equipment placed on the market, broken down by equipment group. You must also separate out the mass of photovoltaic panels, household equipment and non-household equipment placed on the market,

- weight of WEEE collected from households and other sources,

- weight of WEEE treated at the treatment facility,

- weight of WEEE prepared for reuse,

- the mass of waste generated as a result of preparing WEEE for reuse, which was recycled, otherwise recovered or disposed of. Separate out the mass of photovoltaic panels,

- the weight of WEEE exported out of the country for recycling, other recovery or disposal. Separate out the mass of photovoltaic panels,

- achieved annual WEEE collection rate, recovery rate and preparing for re-use rate. Extract data on photovoltaic panels,

- if the above levels are not achieved, information on the product fee payable for each equipment group,

- the list of dismantling and preparing for re-use treatment facilities contracted by you or through a recovery organisation and through which your company or its authorised representative carries out the statutory obligations of the producer,

- the way in which public education campaigns are conducted, indicating whether you carry them out yourself or through a recovery organisation.

Enter all this information in Section V of the report.

Too much paperwork? Tell us your obligations as a producer of electrical and electronic equipment and gain time to develop your business!

If your company introduces batteries or rechargeable batteries, include information in the product report in BDO:

- the type and weight of batteries and accumulators placed on the market,

- a list of waste battery or waste battery treatment facilities with which you have contracted to receive and treat waste batteries and accumulators,

- public education campaigns carried out, indicating the amount of funds allocated for this purpose or the amount of the fee transferred to the account of the marshal's office for the PCE,

Enter all this information in Section VI of the report.

Where to dispose of polystyrene foam? Proper recycling of polystyrene foam

Where to dispose of polystyrene foam? Proper recycling of polystyrene foam

Recycling has never been easier than it is today. Packaging is labelled, the public is educated, but nevertheless we still make mistakes in segregation. What is the reason for this? The problem arises with rarer and mixed waste, such as construction and renovation waste. - We don't know where to throw away crushed concrete, tile scraps or polystyrene foam. Segregating waste can be easy - all it takes is a few educational tips - which is why today's post will tell you where to dispose of polystyrene foam.

In this article, we will answer your questions and prove that the disposal of polystyrene waste is simpler than it sounds!

- into which containers do you dispose of polystyrene waste?

- Where to dispose of polystyrene foam after white goods or consumer electronics?

- Is polystyrene foam recyclable?

- how to dispose of polystyrene foam?

That is, our guide in a nutshell to the amount of polystyrene waste!

What is polystyrene foam and how is it produced?

Styrofoam, or expanded polystyrene (EPS), is a lightweight material consisting of polystyrene granules. It has excellent insulating properties and is resistant to salt and alkalis. As a result, it is widely used in the construction industry and in the packaging of sensitive products. - cups, for example. The production process involves several steps - polystyrene is dissolved in suitable solvents and then a gas (usually pentane) is added, which causes the granules to expand into the familiar polystyrene beads. The finished material is formed into suitable shapes, cooled and then cut to size. Why is it important to dispose of polystyrene foam correctly? As you can see from the production process - it is not a biodegradable material, so inappropriate disposal of polystyrene foam can lead to serious contamination of soils and groundwater. The types of polystyrene foam are often described on the packaging to give the consumer a hint on how to deal with polystyrene waste.

What are the consequences of inappropriately disposing of polystyrene foam in the environment?

The amount of construction waste after renovations can overwhelm even the most persistent. Many people contract companies such as Interzero disposal of construction waste -but where are the polystyrene pieces disposed of and what happens when they end up in the wrong container? The improper disposal of polystyrene foam can lead to a number of negative consequences for both people and the environment. Firstly - it is not a biodegradable material - polystyrene packaging takes up to 1000 years to decomposeIn the meantime, polystyrene contaminates the soil and water. What's more - animals often mistake polystyrene packaging for food, which leads to poisoning and death. In addition, the wrong choice of container makes it difficult to recycle polystyrene foam smoothly.

Where to dispose of clean polystyrene foam? Proper waste management

The Polish system of waste segregation is quite transparent so that waste disposal can be carried out smoothly. Most town hall websites provide information or have their own waste finder, allowing you to allocate the type of municipal waste to the correct bin. You can also use the website Our Garbagewhere you will find a search engine for the segregation rules in your municipality.

Packaging polystyrene is recycled provided it is clean. This group includes, for example, packaging from white goods, furniture and electronic devices. Clean polystyrene should be placed in yellow bags or bins for metals and plastics.. Discarded in this way, it will be recycled, allowing the material to return to circulation. Pure polystyrene packaging is recycled in a similar way to plastic and plastics.

Where to dispose of soiled polystyrene foam? Into which containers?

Dirty polystyrene packaging (e.g. used takeaway food containers) is not recyclable. This type of waste should be disposed of in black bags or mixed waste bins. Why? Removing greasy stains or organic residues is costly and time-consuming, making polystyrene foam recycling uneconomic. This is the only proper disposal of soiled polystyrene.

Where to dispose of building polystyrene foam? Styrofoam waste

Can you dispose of building polystyrene in mixed or plastic? Unfortunately not. Leftover polystyrene boards should be placed in special containers for construction waste. For larger quantities of such waste, it is worth considering using a company that deals with the professional disposal of building materials. Such companies offer transport, suitable containers and proven methods for processing polystyrene foam. This allows you to take care of the environment and comply with waste management regulations. However, if you are dealing with a small amount of building polystyrene, you can take care of the disposal yourself. You can take this waste to your local municipal waste collection point (PSZOK). It will be properly sorted and sent for further processing. This approach makes it easy to dispose of waste in accordance with the principles of segregation and environmental protection.

What are the alternative ways to dispose of building polystyrene foam? Is it possible and cost-effective to recycle polystyrene foam?

- Re-use if the polystyrene is properly cut and painted - an example would be façade polystyrene, which can be used as insulation in another building project or for decoration.

- Surrender directly to polystyrene foam recycling companies. In Poland, we have companies that have made it their goal to recycle this material.

- Upcycling - that is, instead of throwing away used polystyrene foam, we transform it into something new. Homemade decorations, and for the more creative, even furniture or architectural elements.

Before we decide to throw away packaging polystyrene, let's consider whether we can make use of it.

Waste separation and the environment

Appropriate waste management is closely linked to the carbon footprint that remains in the environment. All polystyrene balls, polystyrene plates or soiled polystyrene, remain in the ecosphere. The above alternative ways of disposing of polystyrene are just a few ideas. Municipal waste management has never been at such a high level before in history, but without a committed, informed public, it is impossible to make positive changes to the environment. This is why we encourage people to think about where the waste should be disposed of and whether it is OK - for ourselves - to throw away construction waste without giving it a second thought about its reuse. After all, each of us is responsible for the environment. Do you own larger quantities of polystyrene foam? We hope you already know what you can do with them!

Bio-waste collection to be improved: we only separate 20% of the bio fraction

Bio-waste was supposed to be a source of green fertiliser and clean energy, and its treatment was supposed to be a remedy for the increasing minimum recycling levels of municipal waste. However, reality has turned out to be far from expectations - the collection system for bio-waste is not fully effective and the potential of this fraction tends to go to waste in landfills.

Only 20% of all biowaste is separately collected

Currently in Poland and throughout the EU only a small percentage of the biowaste generated is treated. This applies to both industrial and municipal waste. In a report by Zero Waste and the Bio-based Industries Consortium (BIC) Bio-waste generation in the EU: Current capture levels and future potential it was estimated that each Pole can potentially generate 247 kg of bio-waste. This sum consists of:

- 112 kg of food waste,

- 135 kg of green waste.

The calculation of the theoretical potential was based on a set of public reports and national data.

However, the data made available by the CSO shows that Only 52 kg are collected separately bio waste. Why the difference? Most likely it is due to improper segregation of biowaste - instead of going into the organic fraction, they end up in mixed waste.

According to the calculations of the report's authors, in Poland only selective collection is carried out:

- 9% food waste,

- 20% all bio-waste (food waste + green waste).

In contrast, the average for EU countries is 24.9% for food waste and 30% for the entire bio waste fraction.

As the authors of the report conclude:

The implementation of food waste collection strategies and practices will be one of the main factors in increasing the overall recycling rate of biowaste in the near future.

Untapped potential of food and catering waste

The cited report by Zero Waste and the Bio-based Industries Consortium (BIC) indicates that as much as 75% of the food waste generated in the EU remains unused. This results in the loss of valuable resources that could be processed into natural fertiliser and alternative fuel, as well as excessive methane emissions that occur at landfill sites. To counter waste, Polish entrepreneurs operating in the catering and non-catering sectors are required to enter into a contract for the collection and management of the food waste they produce. They can either conclude this contract with the municipal company or with a specialised waste collection company such as Interzero.

Cooperation with Interzero for the collection of food waste from companies and institutions is a guarantee for its proper management. The waste we collect catering waste is sent to specialised processing facilities - composting and biogas plants, where they undergo composting and fermentation processes. Professional collection of food waste is one of the best ways to make the idea of a closed loop economy a reality and to avoid the legal consequences that incorrect bio-waste management entails.

Industrial composters for food and catering waste

Manufactured in companies food waste can also be managed at sourceon site. To this end, Interzero offers a range of electric composters for industrial use. They make it possible to reduce the volume of waste by up to 90% and turn it into an excellent, nutrient-rich substrate (pre-compost) that can be used as a soil improver, biomass fuel or raw material for anaerobic digestion. The whole the process takes only 24 hours and is odour-free thanks to a deodorisation system.

Oklin's range of composters also includes a unit for home use. Oklin GG-02 compact electric composter can be set up in the kitchen or pantry, providing a more convenient and quicker alternative to composting kitchen waste in a traditional composter.

Sealing the collection of municipal biowaste as an opportunity to meet demanding recycling targets

Household-generated bio-waste that is not managed at source has to be separately collected and then collected by municipalities. However, the collection systems currently in place are not perfect. In order to make it easier for municipalities to carry out the tasks of effective collection and subsequent management of bio-waste, the EIA-PIB has developed a Catalogue of good practice in the collection of biowaste, which presents examples of efficient biodegradable waste management systems in Poland and Europe.

According to a report by the European Environment Agency, bio-waste accounts for approx. 34% of the total municipal waste stream produced within the European Union. In Poland, this percentage was 37.4% in 2023. Given that already from 2025, municipalities will have to reach the 55% municipal waste recycling rate required by EU regulations, emphasis will have to be placed on the recycling of biowaste as the most abundant fraction. Is it possible? We talked about the pains and challenges of bio-waste management with Jan Kolbusz, Chief Technologist and President of Microbiotech in the Eko Bez Kantów podcast Clean energy and fertile soil. How to unlock the potential of biowaste?

Sources:

- https://biconsortium.eu/publication/bio-waste-generation-eu-current-capture-levels-and-future-potential-0

- https://stat.gov.pl/obszary-tematyczne/srodowisko-energia/srodowisko/ochrona-srodowiska-2024,1,25.html

- https://magazynbiomasa.pl/bioodpady-komunalne-jaki-to-potencjal-sprawdz-koniecznie/

BDO annual waste report 2025. - What do you need to know about the waste generated and waste management report?

The beginning of the year also marks the start of the reporting period in which BDO-registered businesses with waste records must submit reports for 2025. Below, we have gathered the most important information and answers to the most common questions about BDO waste reports.

By when is the BDO waste report for 2025 submitted?

An annual report on waste generated and waste management must be submitted by 15 March for the previous calendar year. However, the deadline for BDO reports for 2025 is 16 March 2026. Why 16 and not 15 March? In 2026. 15 March falls on a Sunday, so by law the deadline for the BDO report is moved to the next working day, Monday 16 March.

This, of course, applies to entrepreneurs who are still in business. Entrepreneurs who close their business are obliged to submit a report within 7 days of closing.

Who should file the BDO annual waste report for 2025?

The annual BDO report, known professionally as the annual report on waste generated and waste management, for the year 2025 is required to be submitted by all entities that:

- in 2025 were subject to the obligation to keep waste records in BDO (generated or managed waste),

- in 2025, as part of their operations, extracted waste from a landfill or waste heap on the basis of a waste extraction permit or a decision approving the instructions for operating a landfill during the post-operation phase.

We remind you that the obligation to submit an annual report also applies to entities keeping simplified records waste at BDO!

Don't have a BDO number? Check whether you are obliged to register with BDO!

Do you need to submit a BDO zero waste report for 2025?

Entities that did not generate or treat waste in 2025, are not required to submit a zero report.

How to submit the BDO waste report for 2025?

Annual report on waste generated and waste management to be submitted to the Voivodship Marshal with jurisdiction over the place of production, collection or processing of waste. If you generate, process or collect waste in several provinces, you are obliged to submit reports to the marshals of all the provinces where you carry out these activities.

The report may be completed and submitted only electronicallyvia an individual account in the BDO system. Each entrepreneur can do this on their own or entrust their duty to Interzero experts, gaining a guarantee of efficient, reliable and timely preparation and subsequent submission of reports. Contact us and get the best offer to take over the BDO reporting obligation!

What should the BDO waste report for 2025 contain?

Depending on the entity's areas of activity, the annual report on waste generated and waste management for 2025 may include information on:

- masses and types of waste,

- how waste is managed (applicable to waste managers only),

- installations and equipment for the treatment of this waste, including technical data of the machinery and information on the functioning of the installations and facilities: number of operating hours per day, dates and times of breakdowns or stoppages (only applicable for waste treatment operators),

- amounts of sulphate or chloride in waste per Mg of titanium dioxide produced (applies to entities owning or treating waste from titanium dioxide production processes),

- the weight and types of food waste generated.

In principle, yes. If you have not submitted your BDO report by the deadline, you will you should do this immediatelywithout waiting for a possible inspection or summons from the authorities. This gives you the chance to avoid a severe financial penalty. In settling all reporting backlogs Interzero experts will help you. Contact us and outline your situation and we will help you identify all outstanding obligations and complete the necessary paperwork.

Remember that your company's reporting obligations are only time-barred after 5 years! This means that the authority can summon you to file a report even for up to 5 years back, and additionally impose on your company a fine of up to PLN 5,000.

What is chemical recycling?

Chemical recycling will recover raw materials from contaminated waste fractions

Raw material recycling involves the thermal decomposition of waste, which can produce liquid hydrocarbons or gases that are ingredients for the production of new raw materials. It is used to process certain plastics (e.g. PET, polyethylene, polypropylene). This type of recycling is more energy intensive and more expensive than material recycling, but allows waste that is highly contaminated or heterogeneous to be recirculated (and therefore unsuitable for material recycling).

According to experts, chemical recycling should complement the mechanical recycling currently used to process approximately 80% of plastics. The managing director of the Plastics Europe Poland Foundation, Dr Anna Kozera-Szałkowska, sees it as an opportunity to return to circulation raw materials that can be used for food contact or medical applications[i].

[i] Zero recycling point in Poland, https://portalkomunalny.pl/wp-content/uploads/2024/12/raport-punkt-zero-recyklingu-w-polsce.pdf

How does chemical recycling work? Methods and applications

The chemical recycling process uses 2 basic reactions: breaking and forming new chemical bonds. This means that the plastic particle (polymer) is broken down into smaller particles (including monomers) from which new polymers can be made in the next stage. This produces plastics with identical properties to virgin plastics derived from crude oil.

The most important technologies used during the chemical recycling process are:

- pyrolysis - thermal decomposition proceeding without oxygen. The result is, among other things, pyrolytic oil, from which, after purification and specialised treatment, ethylene and propylene can be obtained, i.e. the monomers that are the basic raw materials for the production of polyethylene and polypropylene,

- Gasification - thermal decomposition occurring when oxygen is available. Almost all plastics can be processed using this process,

- Solvolysis - an exchange reaction between polymer and solvent molecules. It is mainly used for the processing of PET.

However, pyrolysis and gasification do not fall within the statutory definition of recycling - The materials obtained from these processes are sometimes used as fuel. Thus, 'only' energy recovery occurs, which cannot be considered recycling. Nevertheless, pyrolysis is a promising method that can produce polymers with properties identical to those of virgin polymers.

Chemical recycling of plastics is a necessity, not an option

Chemical recycling is not currently used on a large scale. In the publication Plastics Europe[i] indicated that in 2023, only 0.12 million tonnes of plastics were produced in Europe through this process. However, many experts believe that this method should and must be popularisedespecially in the context of the continuing drive to increase plastic recycling levels. As Dr Anna Kozera-Szałkowska emphasises, the sanctioning of chemical recycling technology is also necessary in view of the forthcoming legal regulations concerning the increase in the recyclates content in consumer packaging[ii]..

At Interzero we understand these needs very well and we have long been taking steps to increase the scale of chemical recyclingand at the same time reduce the mass of raw materials going to thermal recycling, i.e. to waste incineration plants. To this end, we have developed a special process for sorting mixed plastics that were previously sent for incineration. In our method, the waste is not sorted into monomaterials, but into streams that are precisely tailored to the requirements of chemical recycling.

In 2023, together with OMV construction of the largest sorting plant for plastic waste has begunwhich will then be sent for chemical recycling. The new Interzero and OMV investment, which will be operational as early as 2026, will have a capacity of up to 260,000 mixed plastics per year.

Learn about all of Interzero's chemical recycling initiatives.

[i] Plastics Europe, Plastics - Facts 2024 in a nutshell, https://plasticseurope.org/pl/knowledge-hub/tworzywa-fakty-w-pigulce-2024/

[ii]. Zero recycling point in Poland, https://portalkomunalny.pl/wp-content/uploads/2024/12/raport-punkt-zero-recyklingu-w-polsce.pdf

Hair and beauty salons must sign up to BDO

With the new year, a new regulation came into force (OJEU 2024, item 1644), in which 5 hazardous waste codes were removed from the list of waste codes exempted from record-keeping, including 2 strictly for the beauty industry. Unfortunately, the exemption that has been in force for the time being, which was readily used by entities generating small amounts of hazardous waste, will disappear. How to prepare for the new environmental obligations?

BDO registration of hair and beauty salons - Interzero support

Registration with BDO is a change for tens of thousands of hairdressers, beauticians and other beauty industry service providers, who until now produced <200 kg/year of waste code 15 01 10*. The BDO system is the Database of Products and Packaging and Waste Management - that is, a system that allows the electronic fulfilment of registration, recording and reporting obligations in Poland. Not sure if your business also needs to register with BDO? Or maybe you don't want to deal with it and prefer to let specialists take over the matter? At BDO registration page for beauticians and hairdressers you'll find a form - you can contact experts from our company who will take over this duty. We act quickly because we've been doing it for years - and you gain valuable time that can be devoted to other areas of running your business. If you need more information about the BDO system, watch our free webinar on BDO.

Fines for failure to register with BDO for beauticians and hairdressers - protect your business

Do you value your hard-earned money? That's another reason to see to the BDO entry. Let's start with the mildest penalty - that is, the one for failing to file a BDO report. If an entity obliged to prepare an annual report on waste generated and waste management does not submit this report, it is subject to a fine - from PLN 20 to PLN 5,000. The penalty for failure to make an entry in BDO, on the other hand, is between PLN 5 000 and PLN 1 000 000. However, these are not the only worries of entrepreneurs. The penalty for waste management not compliant with the information contained in the entry to the register is arrest or a fine - as is the penalty for submitting an application which is not in conformity with the facts. It is also a good idea to know what types of waste there are and which ones are generated by our enterprise. Mixing hazardous waste of different types or mixing hazardous waste with non-hazardous waste is punishable by an administrative fine of between PLN 5 000 and PLN 1 000 000.

Hazardous waste from cosmetic, hairdressing and beauty salons - types and examples

This waste poses a particular threat to human and animal health and the environment. Disposal may only be carried out in dedicated facilities and under strict control. Code 15 01 10* is packaging containing residues of or contaminated by hazardous substances. Concrete examples? Paint cans, oxidisers, brighteners, acetone cans, cleaner cans, packaging containing high concentrations of acids and adhesives.

Are you looking for a company to guide your business through entry into BDO? Complete a simple form for beauty salons, hairdressers and the entire beauty industry - we will contact you!

New product levy rates for glass packaging - sizable reductions from 2025.

New product levy rates for glass packaging - sizable reductions from 2025.

Glass bottles collected under the deposit system will be subject to a lower product fee than expected. The new product fee rates are a result of a decree by the Minister of Climate and Environment, which took effect at the beginning of 2025.

Lower product fee for glass bottles covered by deposit scheme

On 1 January 2025, an amendment to the regulation of the Minister of Climate and Environment came into force, which significantly reduced the rates of the product fee for glass packaging collected under the deposit system. Under the new regulations, For each kilo of reusable glass bottles, introducers will pay:

- £0.01 (instead of £0.10) in 2025,

- £0.05 (instead of £1) in 2026,

- £0.25 (instead of £5) in 2027 and beyond.

Recall that the previous legislation provided for uniform rates for all types of packaging covered by the deposit system. So what is the reason for this change?

Reduction in product fee dictated by higher weight of glass packaging

The amendment to the Regulation was intended to making rates more realistic product levy. As highlighted in the explanatory memorandum of the draft new regulation, the weight of a glass bottle is many times that of a PET bottle or can of identical capacity. Based on the data cited by the Ministry of Climate and Environment, the weights of the half-litre containers covered by the deposit system are respectively:

- PET bottle - 13 g,

- beverage can - 14 g,

- glass bottle - 315 g.

This means that for every 1 kg of packaging:

- 77 PET bottles,

- 71 cans,

- just 3 glass bottles.

In line with the principle that litter the number of packages, not their weight, the product levy rates for glass packaging have been significantly reduced.

Learn about Interzero's comprehensive services for bail participants >>

Environmental justification for a reduction in the product fee for glass packaging

The reduction of the product fee for glass packaging was dictated not only by economic issues, but also by environmental ones. The use of reusable packaging has a positive impact on the environment and brings us closer to making GOZ a reality. The use of returnable glass bottles reduces the scale of production of new bottles, thus reduces carbon emissions, electricity consumption and raw materials.

Maintaining the current uniform rates of the product fee for all of these types of packaging could cause introducers to move away from their use and replace 'expensive' reusable glass with much 'cheaper' single-use plastics. Abandoning reusable glass bottles, on the other hand, would be a a step backwards that would move us further away from the transition to a closed-loop economy.

See also:

Sources:

- Ordinance of the Minister of Climate and Environment of 24 December 2024 amending the Ordinance on the rates of product fees for individual types of packaging, https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20240001960/O/D20241960.pdf

- https://legislacja.rcl.gov.pl/projekt/12389300/katalog/13079739#13079739

From 2025, mandatory separate collection of textile waste. Where to dispose of old clothes and shoes?

From 2025, mandatory separate collection of textile waste. Where to dispose of old clothes and shoes?

From 1 January 2025, textile waste can no longer be disposed of in mixed waste. At the beginning of the year, an amendment to the Act on Maintaining Cleanliness and Order in Municipalities and Certain Other Acts came into force, which obliges all municipalities to carry out separate collection of textile waste.

Selective collection of textile waste on the shoulders of municipalities

Under the provisions of the amendment, from 1 January 2025. each municipality is obliged to organise separate collection of textile wastewhich include, among other things, used clothing and footwear, home textiles (bedding, curtains) and other fabric products. The minimum that municipalities must provide is the possibility of returning all textile waste to the local PSZOK.

At present, there are no top-down plans to introduce an additional sixth bin dedicated exclusively to textile waste or to oblige municipalities to collect this waste fraction from properties. However, municipalities are free to organise additional collection of textile wasteFor example, collecting it directly from households or setting up additional collection points. A similar solution has recently been trialled by the city of Częstochowa, which allows its residents to collect their textile waste free of charge by telephone appointment.

Textile waste under EU scrutiny

The introduction of an obligation of separate collection of textile waste results from the transposition into Polish law of the provisions of Directive 2008/98/EC of the European Parliament and of the Council of 19.11.2008 on waste and repealing certain Directives. Article 11(1) of the Directive obliges all EU Member States to carry out separate collection of at least the following fractions: paper, metal, plastics, glass and textiles. The latter fraction has been compulsorily collected throughout the EU precisely since 1 January 2025.

Let us recall that The European Union continues to work on implementing legislation to increase the efficiency of textile waste collection and impose additional obligations on textile producers, called the extended producer responsibility regime. Under the ROP provisions, textile introducers are to be charged for the costs associated with the collection, segregation and recycling of the waste produced from them.

Penalties for improper separation of textile waste

Selective collection of textile waste means new obligations not only for municipalities, but also for their residents. From the new year it is prohibited to dispose of textiles in the mixed waste bin. Penalties for non-compliance with the new rules or for incorrectly sorting waste can range from 200 to 400% of the basic waste collection fee. It should be noted that these penalties are not a one-off - if residents of the property continue to fail to comply with the statutory obligations, financial penalties may also be charged in subsequent months.

We are already familiar with the mechanism of such penalty fees - similar consequences will also be imposed on us for incorrect sorting of other waste fractions for which separate collection is mandatory (glass, metal and plastics, paper, bio waste). Why are we reminding you of this? Well, a survey we conducted in 2023 showed that only 62% Poles sort waste into all the required fractions, and even fewer, 43%, declare that they can do it correctly. More findings can be found in research report We are getting into trouble.

Where to dispose of old clothes and shoes?

Contrary to what you might think, since January we have not been obliged to return all used textiles to the PSZOK. Used textiles in good condition can be donate to charities (e.g. PCK, Caritas, single mothers' homes, shelters for the homeless) or dispose of in the second-hand clothes container.

Alternative collection points for textiles are also offered by their manufacturers, giving consumers the opportunity to donate old clothes or shoes in their shops. In most cases, these can be products of any brand, which will then be recycled, upcycled or re-marketed in second-hand shops.

As representatives of the waste and recycling industry, we strongly encourage you to act in the spirit of our idea Together for a world without waste which implies not only the proper handling of textile waste, but also the prevention of its generation. How can this be done? Discover 5 ways to go green for fashion and a sustainable wardrobe.

BDO changes - new rules for 2025.

BDO changes - new rules for 2025.

From January 2025, important changes to waste management rules and the operation of the BDO system will come into force. They aim to increase control over waste management, further increase recycling levels and efficiency and protect the environment. See what will change in BDO in 2025 and check if the new rules will also cover your company!

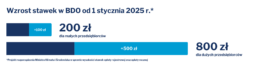

BDO fees up in 2025. - increase of 100% and 166%

The change that will affect all businesses on the BDO register is increase in annual and registration fee. It is dictated, among other things, by the increasing costs of maintaining, running and developing BDO.

From 2025, the BDO fee rates will be:

- 200 z for micro-entrepreneurs (increase from PLN 100),

- PLN 800 for other entrepreneurs (an increase from PLN 300).

As a reminder, the deadline for paying the annual fee for a calendar year is the end of February - so in 2025 it will be 28 February. The annual fee at the new amount must be paid by this date.

New regulations in hazardous waste management in 2025.

From 2025, the introduced an obligation to keep records of all hazardous waste produced by entrepreneurs. This means that existing exemptions will disappearwhich were readily used by those generating small amounts of hazardous waste, including beauticians and hairdressers. Entrepreneurs running beauty and hairdressing salons can have their registration at BDO Interzero - fast, convenient and in 100% online.

Read more about the new responsibilities of the beauty industry in the article: Beauty and hairdressing salons required to register with BDO >>

The recording obligation will cover hazardous waste with the following codes:

- 3 02 08* Other engine, gear and lubricating oils,

- 15 01 10* Packaging containing residues of or contaminated by dangerous substances,

- ex 15 01 11* Metal packaging containing hazardous porous reinforcing components other than asbestos, including empty pressure containers,

- 16 02 13* Discarded equipment containing hazardous components other than those mentioned in 16 02 09 to 16 02 12,

- 16 06 03* Batteries containing mercury.

Do you generate such hazardous waste? Find out if you need to register your company with BDO in 2025!

Further changes to the obligation to separate construction and demolition waste in 2025.

From January 2025. the obligation to separate construction and demolition waste into 6 fractions will come into force. The most recent change, however, is the move away from the need to ensure that R & D waste is segregated at the point of generation -. the trader will be able to pass on the obligation to segregate them to another entity with the relevant permits and entries in the BDO, provided that the relevant contract is signed.

In the previous version of the legislation, the legislator obliged every generator of construction and demolition waste to segregate it at source. As a result of the amendments to the Waste Act, the possibility to segregate waste outside the place of its generation was introduced, but without relieving the entrepreneur of the responsibility for ensuring the implementation of this obligation.

Find out about the new rules for managing construction and demolition waste in 2025.

Postponement of the launch of the Confirmation module in BDO

In 2025. it will not be possible to issue DPR and EDPR documents in the BDO system.. The introduction of the Confirmation Module, which was to allow the digital generation of these documents, has been postponed until 1 January 2027. From this date, businesses will gain the ability to electronically issue DPRs and EDPRs for packaging and products and certificates for electrical and electronic equipment and for batteries and accumulators.

In the period 2025-2026, the documents proving recycling will continue to be issued on paper.

Increase in funding for BDO between 2025 and 2034

From 2025. the limits on the disbursement of funds from the National Fund for Environmental Protection and Water Management for purposes related to the operation of the BDO will be raised. This is to ensure continued seamless access to BDO, as well as maintaining the current level of cyber security and funding the development of the system.

Furthermore, the proceeds from the registration and annual fees for BDO entry will be direct revenue for the NFEPD.